About Credit Insurance

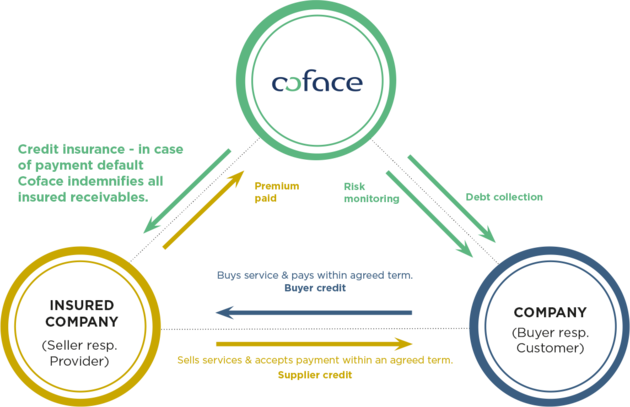

How does it work?

It is an effective financial risk management tool that safeguards your company against losses sustained arising from non-payment of trade related debts.

Credit Insurance ensures that your company is not adversely affected by the unforeseen failure of one or more of your customers; it is also a tool to help you manage your risks.

- Access to credit expertise and market knowledge from a worldwide leader in credit insurance.

- Effective, professional assessment of the financial situation of your customers,

- Indemnification of your unpaid debts

- Global debt collection services available worldwide for debt recovery

WHAT IS THE IMPACT OF AN UNPAID INVOICE ON YOUR TURNOVER?

25% of bankruptcies are due to unpaid invoices

You grant payment terms to your customers every day. And because it’s a routine way of doing business, you may not be thinking about the risk you’re taking.

But what happens when a customer defaults? When a business closes down? When a government suddenly forbids transfer of payments or declares a devaluation?

You might have never experienced any of these situations before, but you ought to know that 25% of bankruptcies are due to unpaid invoices.

How much of your total assets do unpaid invoices represent – and merit protecting?

AND YOU ? DO YOU KNOW THE IMPACT OF AN UNPAID INVOICE?

In your case, for a debt of 50.000, your company needs to generate additional turnover of

500.000 if your operating margin is 5%.