Strengths

- High profitability of pharmaceutical and biopharmaceutical companies, particularly acute in the context of the COVID-19 health crisis

- Strong ability to innovate, in response to demand from authorities as well as patients and their families

- Development of health insurance schemes in emerging countries to deal with diseases related to physical inactivity and a richer diet

- Strong government support via funding, notably after the onset of the pandemic

- High overall barriers to entry favouring incumbents

Weaknesses

- Increasing competition among generics producers

- Greater access to market for biosimilars (generics of biological products)

- Pressure from payers to lower drug prices

- Regulators paying closer attention to the health impact of new therapies through value based medicine

- Rising debt due to the need to fill in pipelines through acquisitions

Risk Analysis

Risk Assessment

Overall, the pharmaceuticals (pharma) sector remains one of the most resilient sectors facing this health crisis (among those for which Coface publishes risk assessments), despite persistent challenges, most of which predate the crisis. The knock-on effects of the COVID-19 shock affected drug sales in many developed countries and clinical trials, which were delayed or abruptly ended due to lockdowns in the second quarter (Q2) of 2020. However, easing of restrictions helped the sector to recover, particularly in terms of drug sales (notably online), and allowed trials to resume. Nevertheless, the pandemic led the global economy into the deepest recession since World War II, which has deteriorated public and corporate finances. Various challenges that Coface analysed prior to the COVID-19 crisis persist. They include official pressure to lower drug prices, criticisms of governments on the perceived lack of transparency in setting prices, distributor segments’ difficulties, and litigations related to drugs’ side effects or downplaying addiction to certain substances.

Notes for the reader

Payer: in the pharmaceutical sector, the payers assess, negotiate and pay for medicines, on behalf of the patients.

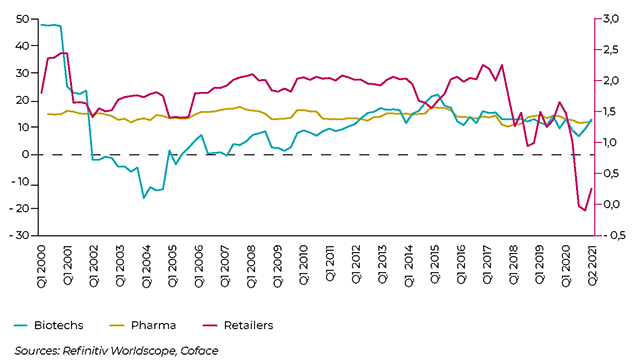

NET MARGIN EVOLUTION IN THE GLOBAL PHARMACEUTICAL LANDSCAPE

Sector Economic Insights

COVID 19: a global shock that affects the pharma sector, which remains resilient overall

Coface considers the pharmaceuticals sector as the most resilient amongst those covered. Pharmaceutical products are essential and are highly priced for serious illnesses. Finally, high barriers to entry stemming from significant Research and Development (R&D) deter new entrants.

Clinical trials were hit hard at the onset of the pandemic in H1 2020, but picked up - in some therapeutic areas - in 2020 second half. IQVIA analysed global clinical trial data for 2020 and found that the number of new trials increased by 8% last year. Oncology saw an increase in its trial activity, as this area is highly sought after due to strong demand from payers and patients alike. Rare oncology indications are recording a push in their share of all oncology-related trials, reaching 63% at end 2020. Other areas saw a decrease in activity, which IQVIA believes is evidence of sponsors and investigators being more interested in addressing diseases related to small populations and offering higher financial rewards.

Clinical trials have embraced the digitalization of processes, as have other industries. Decentralization of trials and remote working (amongst others) have shortened trial times and have helped to improve productivity, even though complexity of processes is high.

The global vaccine rollout will increase revenue

According to data from Our World In Data (as of 29/11/2021), more than four billion people worldwide received one dose of vaccine, while 3.38 were fully vaccinated. Governments around the world are scrambling to secure supply of vaccines from pharmaceutical and biotechnology companies. Western companies are benefitting the most from this race as Pfizer-BioNTech’s vaccine is approved by 95 countries, while AstraZeneca supplies about 91 and Janssen about 76. Sputnik V and Sinopharm reach only 67 and 61 countries, respectively. With such figures, we expect vaccine makers to increase their income in the forthcoming quarters, as governments will request a third or a fourth shot to cope with a surge in variants.

The pre-COVID-19 pricing challenge remains a key issue for payers in a context of expensive innovations

New therapies coming on the market for the treatment of what are often potentially lethal or chronical diseases are primarily contributing to the rise in drug prices at the global level. For instance, AstraZeneca and Daiichi Sankyo’s Enhertu, which combats cholesterol, will cost USD 13,000 per month. In the United States alone in 2021, 300 drugs will witness price increases, with hikes ranging from 0.5% to 10% according to “3 Axis”, which tracks drug prices paid in pharmacies. To justify price increases, pharmaceutical companies are citing lost revenue (as the pandemic affected drug prescription volumes) and the need to reward the effort required to develop vaccines and therapies with high content in R&D. These increases, and the perceived lack of transparency in price setting by pharmaceutical companies, have led to bipartisan initiatives in the Congress to dampen drug price inflation. The Biden plan to lower drug prices (Build Back Better’s provisions related to healthcare), in the U.S. Senate for discussion at the time of writing, would allow Medicare to cap price hikes or to lower prices of certain drugs, those thought as the most expensive. According to some analysts, the plan will start in 2023 by imposing caps on hikes, and will continue in 2025 by lowering prices of the ten costlier drugs, aiming to lower the burden on public finances. Those measures are expected to deliver savings estimated at around USD 160 billion over ten years, if voted by the Senate. The top pharma lobby group expects these provisions and laws to affect the pace of drug launches, while for some advocacy groups, if passed, the bill would have only a modest impact on the ability of pharmaceutical and biotechnology companies to develop and market new molecules.

In China, public authorities are increasingly assertive to expand healthcare regulation. Three major themes are highlighted: enabling an environment for domestic innovation, increasing product quality and pushing for more affordability and accessibility for patients (through price cuts). Oncology is the first therapeutic area to see those themes being applied, particularly through stricter standards for clinical trials. Generics and biosimilars are also targeted by public authorities, via aggressive price cuts asked during call for tenders. In Europe, the higher public debt induced by support measures enacted during the lockdowns could result in lower reimbursement for some drugs. Similar to China and the United States, affordability is a key issue for public payers due to access to market of drugs with high face-value prices.

Pharmaceuticals, notably “Big pharma” actors, are facing criticism and scepticism from governments and public opinion over the lack of transparency in pricing. Calls for greater transparency are coming not only from the United States, but also from around the world. Payers have certain tools at their disposal to limit the budget impact of expensive drugs. One of these is that, in addition to having policyholders sharing payments, payers (particularly in Western Europe) have set up “cost-benefit” assessment systems for each therapy. For instance, in the UK, this value-based approach allows the country’s National Institute for Clinical Excellence (NICE) to refuse to reimburse a drug if it does not significantly improve the survival or quality of life (measured in monetary terms) of patients treated by the National Health Service (NHS).

These methodologies are increasingly being implemented in emerging countries, particularly in China. In the U.S., the Institute for Clinical and Economic Review (ICER) is attempting to implement evidence-based assessment for industry actors, such as CVS Caremark, a Pharmacy Benefit Manager (PBM), which seeks, among other things, to lower drug prices on behalf of health insurers.

Many actors in the pharmaceutical landscape are facing litigations, notably in Europe and in the United States. The opioid crisis in the U.S. will weigh on financial results of some drug distributors and pharmaceutical companies alike. The July 2021 settlement between the three major distributors and the pharmaceutical company Johnson & Johnson with several U.S. local governments reached a total amount of USD 26 billion, which will be paid over

18 years. On the talc powder scandal, Johnson & Johnson will set aside “litigation expenses” up to USD 3.9 billion. However, litigations are not solely tied to companies selling dangerous products. The “price gouging” system developed by Martin Shkreli during the mid-2010’s, a scandal in which his company sold an already amortized drug product after a 5,000% price hike, sent him to jail even though the medicine is highly sought after by patients suffering from lethal diseases such as HIV.

Similarly to the pre-COVID-19 period, drug distributors are still the sector’s most at-risk segment

The most at-risk segment in the pharmaceuticals sector comprises distributors, including wholesalers, as well as retail pharmacy chains. They are bearing the full brunt of price reductions demanded by public and private payers, while their fixed costs are high due to fairly dense and specialised distribution networks. They have to cope, for instance, with the fact that some drugs must be delivered quickly regardless of their destination, while adhering to strict packaging standards. Added to this is increased competition, notably the entry of new players, such as Amazon in the United States. According to Coface estimates, net margin of distributors was slightly above zero (0.25%) at the end of Q3 2021 compared to +1.47% a year ago, a level already much lower than that of pharmaceutical and biotech companies.

Meanwhile, this sub-sector has the second highest net debt-to-asset ratio, which reached 13.1% in Q3. European and Chinese wholesalers have a higher risk profile. In addition to the drastic price reduction policies underway in the region, European wholesalers must also meet tougher standards and regulations. Complying with these rules generates higher costs and affects profitability. In China, the central government is seeking to clean up the segment, which has been largely plagued by non-transparent practices and the presence of intermediaries that have driven up prices. The “double-invoicing” policy makes it easier to monitor transactions: the producer issues an invoice to the distributor, which then invoices its client (hospital or pharmacy).

Last update : June 2023