United Kingdom

Synthesis

major macro economic indicators

| 2020 | 2021 | 2022 (e) | 2023 (f) | |

|---|---|---|---|---|

| GDP growth (%) | - 9.8 | 7.5 | 4.0 | -0.6 |

| Inflation (yearly average, %) | 0.9 | 2.6 | 9.1 | 7.1 |

| Budget balance (% GDP) | -15.0 | -5.7 | -7.0 | -5.4 |

| Current account balance (% GDP) | -2.5 | -2.0 | -5.9 | -5.3 |

| Public debt (% GDP) | 102.6 | 105.6 | 102.0 | 108.0 |

(e): Estimate (f): Forecast *Fiscal year from April to March

STRENGTHS

- Production of hydrocarbons covers three-quarters of energy needs

- Cutting-edge sectors (aeronautics, pharmaceuticals, automotive)

- Financial services

- Competitive and attractive tax regime

WEAKNESSES

- High public and household debt, with the latter being 145% of net disposable income

- Low productivity and training deficit not conducive to innovation

- Regional disparities between the South-East (especially London) and the rest of the country, particularly in terms of transport and energy infrastructure

Risk Assessment

Low growth and high inflation cement the UK as stagflation nation

The UK economy has proven more resilient than expected – similar to many other European economies – as it is battling with high inflation, rising interest rates and diminished real wages. This resilience has until now been driven by a strong labour market that has supported a service sector that is still recovering from the pandemic. The economy has avoided a recession so far but has been seeing an almost stagnating level of activity since early 2022.

Headline inflation is coming down from its late-2022 high and is expected to continue to gradually ease until mid-2024 as energy is pulling inflation down while food and other goods see their price pressures alleviate. However, this will be a slow process as service inflation – highly correlated with wage growth – are proving more persistent due to a tight labour market. Inflation will come down substantially in 2024 compared to the 2022 and 2023 levels but is still expected to remain above the 2% target of the Bank of England (BoE).

The labour market remains tight but is already showing signs of weakening with vacancies slowly coming down from their historic high and unemployment coming up, albeit still at a very low level. A weakening labour market will affect wage growth, but it is still expected to remain high in 2024. The national minimum wage will increase by at least 5.6% in April 2024. This could, along with some unions only reluctantly agreeing to the 2023/24 increase, cause nominal wage growth to average around 5-6% in 2024, and real wages to eventually rise.

The resilient labour market, high wage growth and persistent inflation is forcing the BoE to keep interest rates higher for longer to cool down the economy. The Bank rate, its key interest rate, is expected to end 2023 around the current level 5.25% and remain at this level to at least late 2024, potentially even early 2025.

Despite a fall in real wages over the past year, household demand was relative stable in 2022 and most of 2023 as households were using some of their excess savings accumulated during lockdowns. However, as the excess savings are depleting and unemployment rising, consumption will slowdown in the last part of 2023 and early 2024, but slowly start recovering in the latter half of the year as real wage growth improve purchasing power.

Trade is still slowly recovering from the pandemic and post-Brexit hurdles as overall trade was still lower in the first half of 2023 compared to its pre-pandemic levels. The overall fall is due to trade in goods, which is still 5% below the volume in the first half of 2019, and more specifically trade in goods to European Union (EU) countries as this remained 11% lower. While some of this is expected to gradually recover, smaller and medium sized companies have lost competitive advantages given the higher costs of trade.

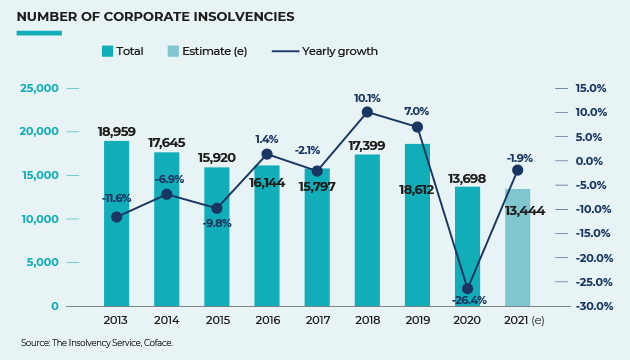

Businesses will continue to struggle with tepid demand, resulting in further difficulties in passing on costs – particularly financial and labour costs – to consumers which also will be reflected in low investments. This will affect margins, that until now have been relatively stable (net rate of return for UK non-financial companies only fell by 0.3pps to 9.9% in Q1 2023 compared to a year prior). Tighter margins and high interest costs will challenge the zombie companies that have been persistent in the economy since the low interest rate environment following the Great Financial Crisis. Insolvencies rose rapidly in 2022 to surpass 2019-levels, following two years with historically low amounts of insolvencies. Insolvencies have and will continue to rise in 2023 (+14% higher in the first nine months of 2023 than a year prior) and is expected to increase further in 2024, albeit at a slower rate.

Stable fiscal policy in response to rising debt financing costs

After a tumultuous 2022, the Spring Budget of 2023 was a relatively safe affair that continued the promise of responsible spending and only minor tax and subsidy changes. It confirmed the rise in the corporation tax (19 to 25% from April 2023) and scaled down the previous ‘super-deduction’ scheme (where businesses could claim 130% capital allowances on qualifying plant and machinery investments) to a ‘full expensing’ scheme, a 100% capital allowances (+GBP 8 billion, 0.3% of GDP). The extension of the Energy Price Guarantee for households (to June 2023), the Energy Bills Discount Scheme for companies (to March 2024) and the extended cut to the fuel duty were among the more expensive measures to ease inflation (GBP 8.2 billion, 0.3% of GDP).

This is resulting in the fiscal balance deficit expected to rise slightly and public debt to rise further as expenditures are expected to outgrow receipts.

After completing the announced reduction of their stock of government bonds and non-investment grade corporate bonds – stemming from the Asset Purchase Facility (APF) – in September 2023 (reducing by GBP 80 billion), the BoE announced a further reduction of GBP 100 billion from October 2023 to September 2024, planning to reduce its holdings to GBP 658 billion.

Both exports and imports are expected to drop in 2023 and only somewhat recover in 2024, but the recovery will be slow and while the Windsor Framework improved the relationship with the EU, the trade frictions are still there, and automotive exports may not recover. The current account deficit will remain stable in 2023 and gradually narrow in 2024. However, it will remain negative with the balance of goods showing a deficit, despite improvements, whereas the balance of service will have a surplus as it remains a key part of the global financial sector.

Campaigning is slowly beginning as 2024 will likely be an election year

The next general election has to at the very latest be held in early January 2025, but given that an election period over Christmas seem rather unlikely, 2024 will probably be an election year. As Rishi Sunak, the Conservative prime minister, came up to a year as prime minister in October 2023, he has so far not seen much change in the polls with his party still polling around 27%, well below the Labour (left), the main opposition party (45%) – roughly unchanged between the two compared to November 2022. It is therefore expected that he will hold back on calling an election for as long as possible, especially to distance himself from memories of high inflation and continuous strikes. It is also possible that a decision to call an earlier election around April 2024 if the conditions are favourable – inflation is expected to be low compared to previous years’ levels and could potentially follow the Spring Statement.

While political tensions, both domestically and internationally, have eased compared to their peak in 2022, they still persist. Tensions between the Government and unions around wages continue to be present, and there are still a significant number of strikes. The 12-month period to June 2023 saw 4 million total working days lost – the highest amount since 1990. The government is still working pro-actively on a trade deal with India, although there is still much disagreement about several points –including easing visa restrictions on Indian professionals and the UK accepting India’s standards on environment protections and labour. Meanwhile, the relationship with the EU has improved after the Windsor Framework was announced in February 2023 – and adopted the following month.

Last updated: November 2023

Payment

Cheques are still used for domestic and international commercial payments, although bills of exchange and letters of credit are preferred for international transactions. Bank transfers – particularly SWIFT transfers − are also often used and are viewed as a fast and reliable method of payment. Direct Debits and Standing orders are also recognised as practical solutions for making regular or anticipated payments and are particularly widely used in domestic transactions. It is acceptable to issue invoices both before and after the supply of goods or services.

Debt collection

Amicable phase

The debt collection process usually begins with the debtor being sent a demand for payment, followed by a series of further written correspondence, telephone calls and (if the value of the debt permits), personal visits and debtor meetings. The collection process has been designed as a progression of stages, beginning with an amicable (pre-legal) collection phase and escalating up to litigation, should the debtor fail to meet his obligations.

Legal proceedings

The County Court only has civil jurisdiction. Judges handle claims for debt collection, personal injury, breach of contract concerning goods or property, land recovery and family issues (such as divorce and adoption). Cases valued at less than GBP 25,000 (or under GBP 50,000 for personal injury cases) must have their first hearing in the county court.

The High Court is based in London, but also has provincial districts known as “District Registries” all over England and Wales. It has three divisions: the Queen’s Bench Division, the Chancery Division, and the Family Division.

The Court of Appeal has two divisions – the Civil Division and the Criminal Division.

The Supreme Court is composed of a president, a deputy president, and twelve professional justices.

Fast-track proceedings (Summary Judgments)

In order to apply for a summary judgment, the claimant must obtain an Application Notice Form from the court. This should be supported by a Statement in which the claimant sets out why he believes that summary judgment should be given − either because the defendant has no real prospect of successfully defending the claim, or because there is no reason why the case should be decided by a full trial.

A copy of this statement is served on the opponent seven days before the summary judgment hearing. The opponent also has the opportunity of presenting a statement, but this must be sent no later than three days before the hearing. The claimant cannot apply for summary judgment until the debtor has either returned an acknowledgment of service form, or has filed a defence. If the court agrees with the claimant, it will return a favourable judgment. The application will be dismissed if the court does not agree with the claimant.

Ordinary proceedings

There are now identical procedures and jurisdictions for the County Court and the High Court. A number of litigation “tracks” have been created, each with their own procedural timetables. Claims are allocated to a track by a procedural judge, according to their monetary value. There are transaction processes that need to be followed before initiating a court action. These processes have been designed to encourage the parties concerned to settle disputes without the need for court proceedings, thus minimising costs and court time.

Proceedings formally commence when the claimant (formerly “the plaintiff”) files a Claim Form with the County Court or the High Court. Full details of the complaint are set out in the Particulars of Claim, which is usually a separate document which supports the Claim Form. The Claim Form must be served on the defendant by the court, or by the claimant. The defendant can then respond to the claim form within 14 days of service. A time extension of 28 days is agreed for the debtor to file a defence and/or a counter-claim. Once these formal documents have been exchanged, the court orders both parties to complete an “Allocation Questionnaire”.

Freezing order (formerly Mareva Injunction)

A freezing order (or freezing injunction) is a special interim order which prevents the defendant from disposing of assets or removing them from the country. One of the conditions attached to the granting of such an order is often that the applicant will pay full costs to the person against whom it was made, if it turns out to be inappropriate. A typical commercial dispute can take 18-24 months to reach a judgment, starting from the time legal action is first initiated.

Enforcement of a Legal Decision

A number of enforcement mechanisms are available. These include the Warrant of Execution (which allows a County Court Bailiff to request payment from the debtor) and the Writ of Fieri Facias for debts exceeding GBP 600, under which a High Court Enforcement Officer can make a levy on goods to the equivalent value of the judgment debt (for subsequent sale at auction and offsetting against the amount due).

As a member of the European Union, the UK has adopted several enforcement mechanisms for decisions rendered in other EU countries. These include EU payment orders which are directly enforceable in domestic courts and the European Enforcement Order, for undisputed claims. Judgments issued in non-EU countries are recognised and enforced if the issuing country has an agreement with the UK. If no such agreement is in place, an exequatur procedure is provided by English Private International Law.

Insolvency Proceedings

Administration

Administration is intended as a rescue mechanism which enables companies (wherever possible) to continue with their business operations. The procedure is initiated either by applying to the court for an administration order, or by filing papers with the court documenting the out-of-court appointment of an administrator.

Company Voluntary Arrangement (CVA)

The CVA is an informal but binding agreement, between a company and its unsecured creditors, in which the company’s debts are renegotiated. It can be used to avoid or support other insolvency procedures, such as administration or liquidation. It provides for a restructuring plan which imposes the support of dissenting creditors.

Creditor’s Scheme of Arrangement

The Creditor’s Scheme of Arrangement is a court-approved compromise or arrangement, between a corporate debtor and all classes of its creditors, for the reorganisation or rescheduling of its debts. It is not an insolvency procedure and does not include a moratorium on creditor action. It can, however, be implemented in conjunction with formal insolvency proceedings, (administration or liquidation). It can also be implemented on a standalone basis by the debtor company itself.

Receivership

There are three types of receivers. The first of these is a receiver appointed with statutory powers. The second type of receiver is one who is appointed under the terms of a fixed charge or a security trust deed. The third category is an administrator (who is appointed under the terms of a floating charge over all, or a substantial share, of the debtor company’s property.

Liquidation

A company can enter voluntary or compulsory liquidation. Voluntary liquidations can be either a “members’ voluntary liquidation” or a “creditors’ voluntary liquidation”. Both of these proceedings are initiated by the company itself, by passing a resolution during a meeting of members. The company then ceases trading and a liquidator collects the company’s assets and distributes the benefits to the creditors so as to satisfy, as far as possible, the company’s liabilities.